Financial/Retirement Planning

For Business, Personal & Family

Estabrook & Company was founded in 1996 with two goals: to provide personal guidance for complicated tax situations, and to give peace of mind to those investing and planning for retirement. Who we are, and who we serve is the basis for everything we do and how we do it. Our core values are behind every decision we make, as we search for the best way to serve you.

- Integrity — We are dedicated to keeping our promises to you. We believe that our collective wisdom is stronger than any one of us, consequently we meet every week to discuss economic changes, investments, technology enhancements, and accountability.

- Compassion — We understand that most people fear discussing major financial decisions. By explaining what seems complicated and confusing, we help remove those fears and aid you in achieving your goals.

- Leadership — We are confident that by listening and discovering what matters most to you, we can confidently create a financial path towards achieving your specific goals.

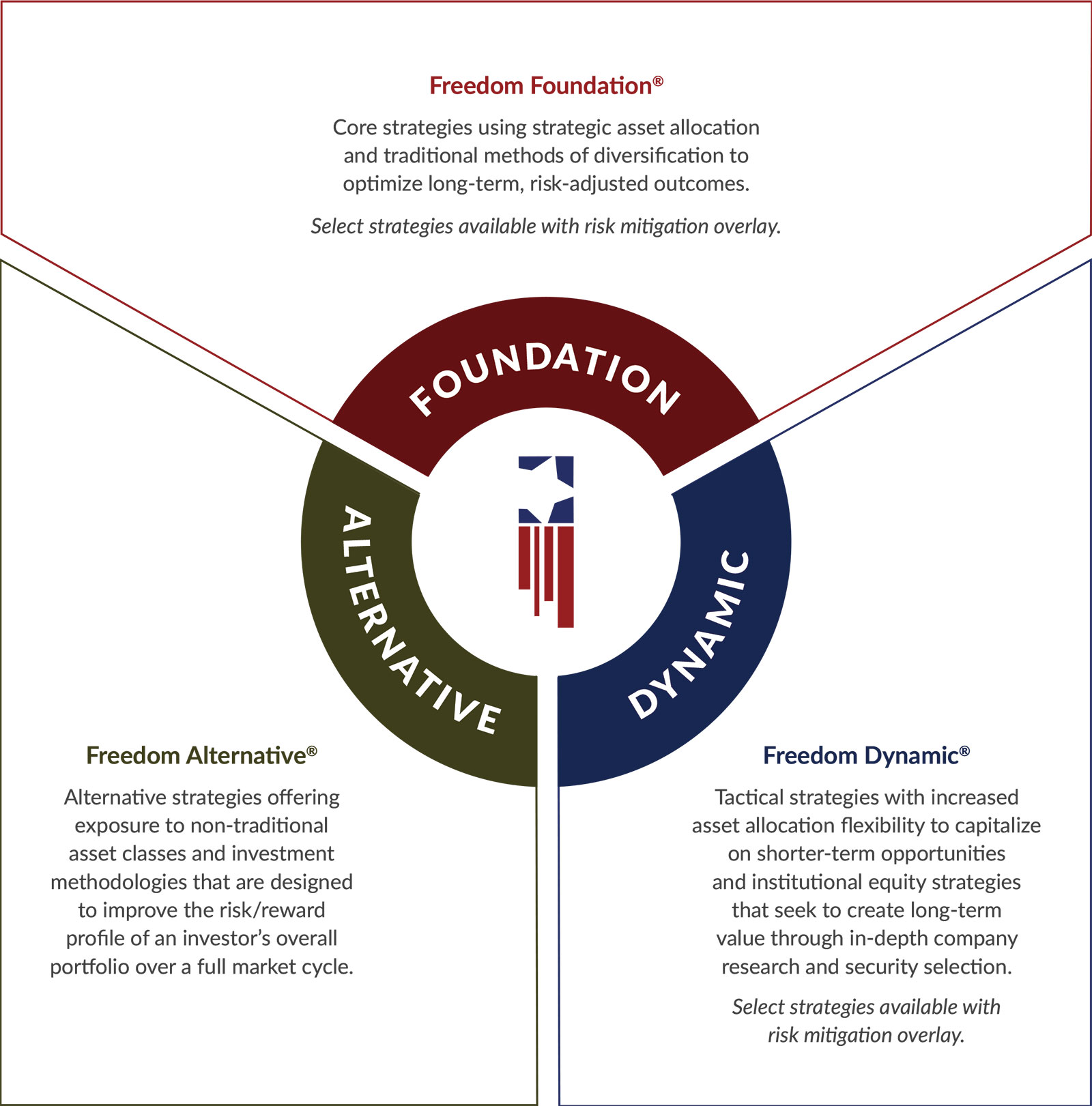

Investment Management

Helping you achieve your goals and dreams

Comprehensive vs Investment Plan:

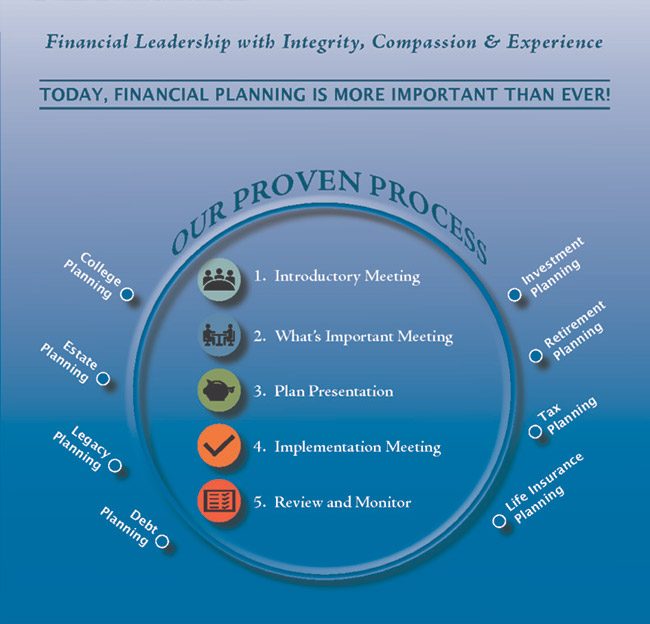

Our Comprehensive Financial Plan includes 3 meetings and the analysis covered is tailored to you:

- Retirement plan

- Investment proposal and risk analysis, annual review of investment accounts and online access

- Estate planning documents such as a Last Will and Testament and a Living Will (Healthcare Directive)

- Legacy planning

- Insurance review

- College planning

- Debt planning

Our Investment Plan includes 2 meetings and is specific to recommendations to a particular investment or savings which includes:

- An investment proposal and risk analysis

- Annual review of your investment accounts

- Online access to a live feed reflecting your total net worth

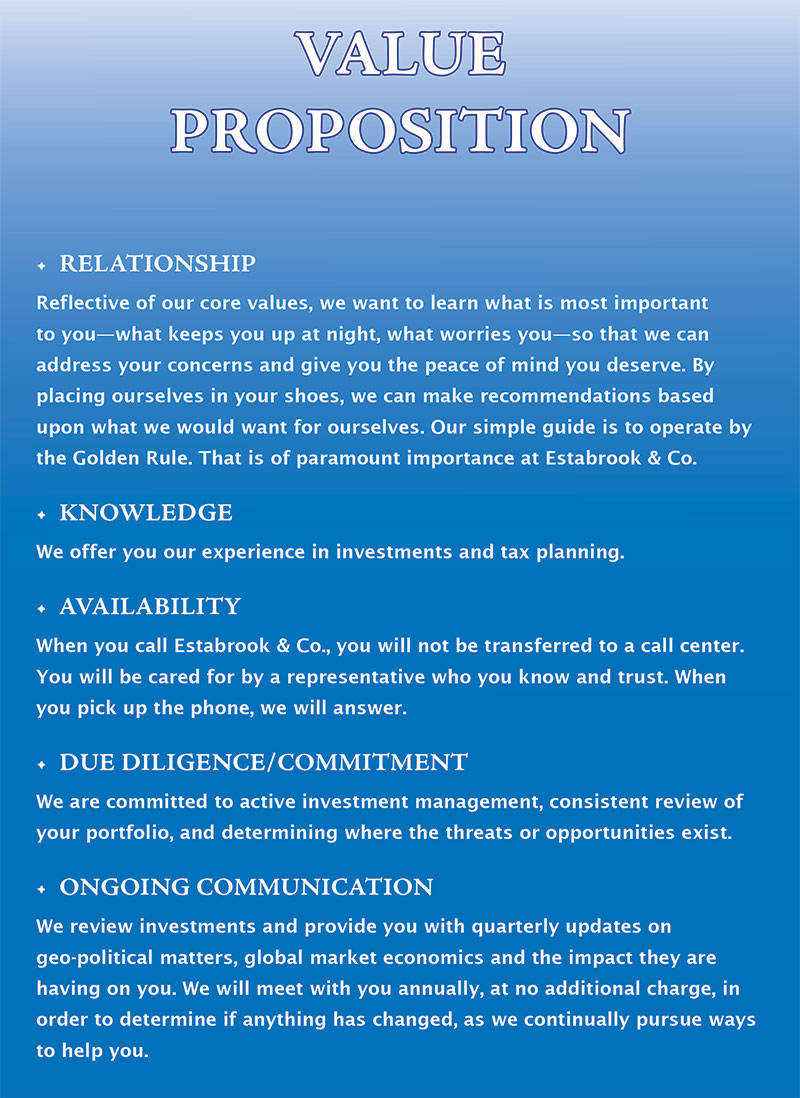

Click here for our Value Proposition.

You may be asking yourself “What does Financial Planning mean to ME?”

Any of the following scenarios would prompt a financial planning meeting:

- Change of job

- Change of marital status

- An employer (401k or 403b) plan eligible for rollover

- Having kids and planning for college costs

- Calculating how much to save each month for retirement

26

Best-Interest

4

Our Services

Financial Planning

We engage our clients in 1 of 2 ways, Comprehensive or Investment Plans.

Retirement

Making your retirement goals and dreams a reality!

Lifestyle

Live now like no one else, so that you can LIVE and GIVE later like no one else!

Investing

Our approach to wealth management.

College Planning

Save a little now. Have a lot later - and tax-free!

Estate Management

Leave your affairs in good order with a Last Will and Testament.

Insurance

Protect the ones you love.

Tax Management

Pay as little tax as possible!

Meet the Team

Jay Estabrook

Nathan Estabrook

Allan Randall

Beth Estabrook

BillieJo Monk

Jay Estabrook

Incorporating retirement planning and investment management into his tax business has proven to be a valuable resource to our clients. This holistic approach provides the critical and timely information that families need most when making major financial decisions.

Prior to founding Estabrook and Company in, Jay Estabrook served as the Chief Financial officer for a Regional Telecommunications company. He was responsible for developing and implementing their financial and customer service data systems, as well as overseeing all accounting and treasury functions. He was also involved in assisting them with going public.

Mr. Estabrook is a Certified Public Accountant and holds a Bachelor’s of Accounting and Finance degree from the University of Maine. He also holds a master’s degree in accounting from Kansas State University and a Masters in Tax from Bentley College. He has a Theology degree from Maryland Bible Seminary in Baltimore Maryland and is an Investment Advisor Representative through Founders Financial Securities, LLC.

Check the background of this investment professional on FINRA’s BrokerCheck.

Jay Estabrook

Incorporating retirement planning and investment management into his tax business has proven to be a valuable resource to our clients. This holistic approach provides the critical and timely information that families need most when making major financial decisions.

Prior to founding Estabrook and Company in, Jay Estabrook served as the Chief Financial officer for a Regional Telecommunications company. He was responsible for developing and implementing their financial and customer service data systems, as well as overseeing all accounting and treasury functions. He was also involved in assisting them with going public.

Mr. Estabrook is a Certified Public Accountant and holds a Bachelor’s of Accounting and Finance degree from the University of Maine. He also holds a master’s degree in accounting from Kansas State University and a Masters in Tax from Bentley College. He has a Theology degree from Maryland Bible Seminary in Baltimore Maryland and is an Investment Advisor Representative through Founders Financial Securities, LLC.

Check the background of this investment professional on FINRA’s BrokerCheck.

Nathan Estabrook

Nathan is our Vice President and Registered Representative. He holds a Series 7 license and an Insurance license. He graduated with a bachelor’s degree from Villa Julie College and has over 15 years of experience in Accounting, Tax preparation and Financial Planning. Nathan specializes in tax preparation both personal and business. He works as part of the financial services team creating and presenting financial plans. In his spare time, he enjoys spending time with his family. Check the background of this investment professional on FINRA’s BrokerCheck.

Beth Estabrook

Beth has been serving in the Financial Services Department at Estabrook & Company since 2008 as a licensed Series 7 and Series 66 Investment Advisor, as well as a licensed Life, Health, Accident, Property & Casualty Insurance Agent. She graduated from Towson University with a bachelor’s degree in Finance and an associate degree in Accounting. Beth supports families and business owners with financial, retirement, and college planning, as well as debt management, investment portfolio construction, research and ongoing wealth management. She also assists Jay Estabrook, Nathan Estabrook, Allan Randall and BillieJo Monk in serving Financial Services clients. Beth upholds investment disciplines in the department such as active management, modern diversification, risk mitigation and holistic financial planning. She lives in Pennsylvania with Nathan and their two sons, Caleb and Connor. She loves traveling to Florida to see her parents and spending time on the beach! Check the background of this investment professional on FINRA’s BrokerCheck.

BillieJo Monk

BillieJo joined Estabrook & Company in 2012. She holds a Life Insurance license and is currently completing her Series 7 license. BillieJo works in the Financial Services department at Estabrook & Company and focuses on client account management, financial plan design, client annual reviews and fund transfers. Before her switch to the financial world, BillieJo worked as a chemist for 15 years. She graduated Summa Cum Laude from Shippensburg University of Pennsylvania with a bachelor’s degree in Chemistry. BillieJo lives in Pennsylvania with her husband and 2 daughters.

Allan Randall

Allan joined Estabrook & Company in the beginning of 2015. Allan is a tax accountant and a financial advisor. He holds a Series 7 license and specializes in tax and retirement planning. Allan graduated from Towson University in 2011 with a degree in Business Administration with a focus in Management. Allan has a diverse sales/management background having worked as an Account Representative at Ripken Baseball and Randstad Technologies where he worked in sales and recruiting. When he isn’t in the office, Allan loves spending time with his wife, Emily and their four children, Paisley, Isabella, Savannah, and Charlie. Check the background of this investment professional on FINRA’s BrokerCheck.

Sue May

Sue May is new at Estabrook & Company. A graduate of Anna Maria College, she spent 40-plus years in the Graphic Arts industry. In addition to her work in graphic design, Sue also functioned as a copywriter and an editor, and helped to establish and run a print shop for a non-profit organization. ASL (American Sign Language) is one of Sue’s passions, and she serves as a volunteer interpreter on a weekly basis. When vacationing with her husband Bruce, Sue loves hiking the many trails of Acadia National Park, exploring Bar Harbor, catching the sunsets on Cadillac Mountain, and returning to the cabin with a good book.

Steven Estabrook

Steven has been with Estabrook & Company since 2014. He holds a bachelor’s degree in accounting from Towson University. Steven is the manager of the Estabrook & Company bookkeeping department. He also prepares personal & corporate tax returns, quarterly estimates and settles small tax compliance issues for the tax department. Steven, his wife Amanda and their two kids Ella & Wyatt live in Seven Valleys Pennsylvania. They love camping, hiking and exploring state and national parks.

Tina

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc lacus elit, tincidunt a felis vel, vehicula viverra nibh. Aenean mollis quam vel tortor laoreet, id placerat ligula eleifend. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; In feugiat placerat nisi, vitae eleifend massa sollicitudin id. Nulla vehicula congue hendrerit. Donec ut justo enim. Mauris porta efficitur velit, ut accumsan leo mollis non. Sed efficitur vitae lacus in efficitur. Aenean est nisl, suscipit non dictum ut, cursus sit amet felis. Duis posuere elit dictum dapibus pellentesque. Nulla ligula magna, imperdiet ut velit et, dignissim scelerisque mauris. Aenean vel venenatis neque, a egestas odio. Suspendisse in ipsum et ante porta pulvinar sed a risus. Etiam tempor maximus tellus id tincidunt.

Dawn

Dawn is the Assistant Manager of the bookkeeping department. She has over 27 years of business experience, 12 of which are in the public accounting field. She has worked for Estabrook and Company for 4 years. In her spare time, she loves to paint and spend time with her daughter.

Betsy

Betsy has been a bookkeeper for Estabrook and Company for almost 3 years. She has 8 years total of bookkeeping experience. She has 3 children, 2 boys and 1 girl, and she enjoys raising her newest child, a puppy.

Ann-Marie Estabrook

Ann-Marie is our office manager who has been working for Estabrook and Co. for over 20 years. She has a bachelor’s degree from MBC&S and an associate degree from Manhattan Area Technical College.

David Estabrook

David has been working for Estabrook and Co. for the past six years. He helps to complete Personal Property Tax preparation. He also assists in the preparation and filing of Incorporations, entity changes and dissolutions.

Arden Bailey

Arden is our full-time receptionist who has been working with us since 2014. She is an avid reader and enjoys photography and traveling to the countries she reads about.